Introduction

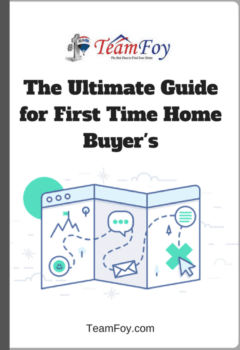

The Ultimate Guide for a First Time Home Buyer

Don’t have time to read the whole guide right now?

No worries. Let me send you a copy of the full 65-page eBook so you can read it when it’s convenient for you. Just let me know where to send it (takes 5 seconds):

You’re here today because you’ve been renting, living on a friends couch, or staying at home with mom and pap. Right?

And recently you started thinking seriously about purchasing a home, but you’re still unsure about the process. How does it work? How much home can I afford? How do I find a real estate agent I can trust?

As a first time home buyer, your mind is probably even fantasizing about the dream house you wish you could purchase. Maybe it’s one you drove by this past weekend or one you saw on an HGTV show.

You know..the one with the pool in the back yard. Stainless steel appliances in the kitchen. A master bedroom with massive closet space and a bathroom that includes a walk in shower plus a Jacuzzi.

Everyone loves the idea of owning their dream home.

But not everyone is going to make it happen.

The Good News: You don’t need to be perfect or rich. Or the smartest person in the room. Or lucky. We’ve been able to help many people in your shoes become first time home buyers. And that’s what this guide is all about. You can end your money worries, feelings of overwhelm, and the frustration of sifting through the mountains of information.

In this guide you’ll learn:

- Part 1: Home Buying Mistakes to Avoid

- Part 2: How to Improve Your Credit Score

- Part 3: Things to Consider Before Buying

- Part 4: The Home Buying Process from A to Z

- Part 5: What to Do as a New Homeowner

Part 1: Home Buying Mistakes to Avoid

Wouldn’t it be nice if you knew exactly what NOT to do ahead of time? Imagine this section as your mentor high lighting the moves to avoid making to save you money and heartache down the road.

Part 2: How to Improve Your Credit Score

It’s crazy how many thousands of dollars you’ll save over the lifetime of your mortgage for every half of a percent decrease to your interest rate. This section will show you how to build strong credit so you can get the lowest rate possible on your loan and save thousands of dollars.

Part 3: Things to Consider Before Buying a Home

Do you know what you want in your first home? What features? What price range? What location? In part 3, we cover all the things to think about before you start property hunting so you’re prepared for this big milestone in your life as a first time home buyer.

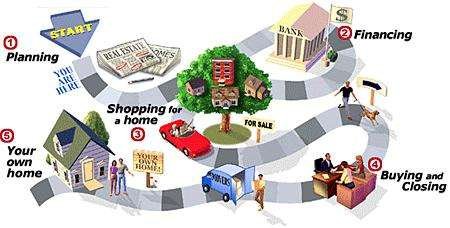

Part 4: The Home Buying Process

The number one concern most first time home buyers have is not understanding the home buying process. This part is your guide to the steps you’ll take during the home buying process so that you know what to expect and how to go through each stage like a pro.

Part 5: What To Do As A New Home Owner

Once the deal has closed and you’ve become a homeowner, you’re going to want to know what to do to be successful and maintain your home. This part will cover the key responsibilities and actions you can take to ensure you are successful over the long run as a home owner.

Ultimate Guide for a First Time Home Buyer – Part 1

Home Buying Mistakes to Avoid

Who is a first time home buyer?

Let’s first run through the 3 most common definitions of a first time home buyer. For the majority, it’s people who have never owned a home before in their life. But there are some people out there wondering if they qualify as a first time home buyer due to life situations they’ve been in before with a spouse. You are considered a first time home buyer if you are:

- An individual who has not owned a principal residence for three years

- A single parent who has only owned a home with a former spouse while married

- A displaced home maker who has only owned with a spouse

Being a first time home buyer has it’s benefits because there are first time home buyer programs that you may qualify for and aid you in your home buying experience.

Now that we’ve shed some light on what constitutes a first time home buyer, let’s talk about the things you need to consider before you buy a new home. These will set you up for greater success in the long run due to preparation you take today.

Mistake #1: Taking on a bigger mortgage than you can afford

House shopping can be a lot of fun. You may even end up in some neighborhoods that are pricey and tempting to pursue. The biggest mistake you can make is taking on a mortgage that you can’t afford. Make sure you have your finances in order before house shopping.

One factor banks look at heavily is your current debt to income ratio. If you want to afford more home and qualify for a larger loan, lower your current debt payments in other areas of your life: student debt, credit card debt, auto loan debt, etc.

I know, I know. Debt sucks. You wish it was easier to get rid of.

If you’ve got a pile of bills to pay, it’s probably not your fault.

We aren’t born knowing how debt works. There’s no “pay off your loans” class in high school. And the credit card companies aren’t out to help you. In fact, they’re in business to keep you in debt until you die.

Step 1: Find out how much debt you have

Login to your accounts, call the company, do whatever it takes to find out how much you currently owe on your credit card(s), auto loan, and/or student loans!

Step 2: Prioritize your debt and attack it

Look at all the interest rates on your debts and rank them from highest to lowest. Go after the highest interest rates first and work down the ladder as you pay each off.

Step 3: Lower your interest rates to save thousands

It’s as simple as making a phone call to the different companies you currently have debt with and negotiate with them to lower your interest rate.

Step 4: Find hidden cash to pay your bills

Increase your income by asking for a raise or finding a part time job. Look for everyday expenses to cut down on and apply these savings toward your debt pay down.

By getting your debt situation in control, you are more stable in the eyes of the bank and more stable in reality to handle the mortgage debt payments you’ll be taking on as a new home owner.

Mistake #2: Forgetting about the hidden costs

You factored in the purchase price and mortgage payment but forgot about property taxes, insurance, utilities, and fees. Closing costs can include: appraisal fee, home inspection fee, lender financing costs, title insurance, and other fees.

Hidden Cost Rules of Thumb:

- Property taxes are usually 1% of the home value

- Property Insurance usually 1% of home value

- Closing costs & fees usually 3% to 5% of purchase

Mistake #3: Not using a buyer’s agent to represent you

Do you know who pays for the commissions of real estate agents? The seller does. This means the buyer’s agent who works with you during the home buying process is free to use! Don’t make the mistake of trying to go at it alone because you think that you’re responsible for paying the commission. A buyer’s agent will be able to explain the home buying process to you as well as walk you through it step by step. Most importantly, they are professional negotiators and will save you money.

Mistake #4: Using the seller’s agent

Another mistake first time home buyers make is using the seller’s agent. The seller’s agent represents the seller, so do you think this agent will have your best interest at heart? Probably not.

A common situation where this occurs is when a first time home buyer goes to an open house the seller is having and talks to the listing agent about buying the home. You’re not obligated to work with any specific agent until you’ve signed a contract with them. You can speak to the listing agent about the property at the open house, but you aren’t required to work with them. Make sure to give your buyers agent a call if the open house goes well and peaks your interest in making an offer on the home.

Mistake #5: Not fixing your credit score

Make sure to review your credit report a few months before you start making serious moves to purchase a home. This will give you time to find errors or issues on your report that need resolved. By resolving issues, you’ll boost your credit score that was mistakenly damaged from errors on your report and this will help you secure better terms on your loan such as a lower interest rate.

Don’t have time to read the whole guide right now?

No worries. Let me send you a copy of the full 65-page ebook so you can read it when it’s convenient for you. Just let me know where to send it (takes 5 seconds):

Ultimate Guide for a First Time Home Buyer – Part 2

How to Improve Your Credit Score

5 Ways to Boost Your Score:

- Pay off your card regularly

- Get all fees waived

- Negotiate a lower interest rate (APR)

- Keep your cards active and keep them for a long time

- Raise your credit limit to lower your credit utilization ratio

The 5 Commandments of Building Your Credit

1. Pay off your credit card regularly

Your debt payment history makes up 35% of your credit score – the largest chunk. Paying your bills on time is the most important thing you can do. It not only builds your debt payment history but shows banks you will be responsible in paying off the mortgage just like you are with your credit card. If you miss one payment, here are 4 things that unfortunately can happen:

- Your credit score can drop more than 100 points, which would add $240/month to an average thirty-year fixed-mortgage loan. That’s an extra $3,000 per year!

- Your APR can go up to 30 percent. Yikes!

- You’ll be charged a late fee, usually around $35.

- Your late payment can trigger rate increases on your other credit cards as well, even if you’ve never been late on them. (I find this fact amazing.)

Don’t get too freaked out: You can recover from the hit to your credit score, usually within a few months. In fact, if you’re just a few days late with your payment, you may incur a fee, but it generally won’t be reported to the credit bureaus.

I’d recommend setting up automatic online payments for your credit cards so you never have to worry each month.

2. Get all fees waived on your card

Do you still have credit cards that charge annual fees?

The vast majority of people don’t pay any annual fees on their credit cards, and because free credit cards are so competitive now, you rarely need to pay for the privilege of using your card. The only exception is if you spend enough to justify the extra rewards a fee-charging account offers.

To remove fees, call your credit card customer service number and speak with a credit card rep. Ask them if you are paying any fees currently on any of your credit cards and if they say yes, ask them what other card options are available that have no fees. You can also threaten to close your account while asking them to waive fees on your current cards

3. Negotiate a lower APR

Your APR, or annual percentage rate, is the interest rate your credit card company charges you. The average APR is 14 percent, which makes it extremely expensive if you carry a balance on your card. Put another way, since you can make an average of about 8 percent in the stock market, your credit card is getting a great deal by lending you money. If you could get a 14 percent return, you’d be thrilled — you want to avoid the black hole of credit card interest payments so you can earn money, not give it to the credit card companies.

So, call your credit card company and ask them to lower your APR. If they ask why, tell them you’ve been paying the full amount of your bill on time for the last few months, and you know there are a number of credit cards offering better rates than you’re currently getting. In my experience, this works about half the time.

It’s important to note that your APR doesn’t technically matter if you’re paying your bills in full every month—you could have a 2 percent APR or 80 percent APR and it would be irrelevant, since you don’t pay interest if you pay your total bill each month. But this is a quick and easy way to pick the low-hanging fruit with one phone call.

4. Keep your cards for a long time and keep them active

Lenders like to see a long history of credit, which means that the longer you hold an account, the more valuable it is for your credit score. If you’re happy with your current credit card and reward points, keep it. If you’re going to get a new credit card soon, don’t close your old credit cards. Try to keep these open and active as long as there are no fees for doing so.

To keep a card active, find one expense such as your Netflix subscription that you can have automatically billed to your old credit card each month. This shows credit card companies your still using that card and avoid the possibility of them shutting it down or charging fees for an inactive account.

5. Get more credit. (Warning! Only if you have no debt)

I’m serious about this warning: This tip is only for people who have no credit card debt and pay their bills in full each month. It’s not for anyone else.

One of the major factors of your credit score is something called the credit utilization rate and it accounts for 30% of your credit score. This is simply a ratio that is calculated by taking your credit used each month divided by your total available credit. For example if you use $1,000 in credit each month and your card limit is $5,000 then your utilization rate is 20%.

When you get more credit available while maintaining the same amount of credit used, your credit utilization ratio will decrease. For example, if you add another $5,000 credit card to your wallet you now have $10,000 in available monthly credit. If you continue spending only $1,000/month on credit your utilization ratio is now only 10% ($1,000/$10,000).

Your alternative option is to lower your spending. For example, if you’re spending $3,000 per month on credit and have $5,000 available, then your utilization is a staggering 60%! This is high. You want to maintain a ratio less than 30%. Decrease your spending with credit to reduce your ratio back down to a healthy level. Keeping a low ratio is what credit companies want to see and will boost your credit score.

Ways to increase available credit include:

- Getting a second credit card

- Increasing the limits on your current credit cards

Here’s how: Call up your card company and ask for a credit increase.

You: Hi, I’d like to request a credit increase. I currently have five thousand dollars available and I’d like ten thousand.

Credit Card Rep: Why are you requesting a credit increase?

You: I’ve been paying my bill in full for the last eighteen months and I have some upcoming purchases. I’d like a credit limit of ten thousand dollars. Can you approve my request?

Credit Card Rep: Sure. I’ve put in a request for this increase. It should be activated in about seven days.

Ultimate Guide for a First Time Home Buyer – Part 3

Things to Consider Before Buying a Home

Is it really time for you to buy a home?

I had a client once who was looking at homes for sale in Elkhart IN and I asked him why he was buying a home. His response was “My uncle told me it’s a buyers market and a great time to buy.”

So my question to you is are you looking to buy because you’re ready to become a homeowner or because of one of the following reasons:

- A family member told you it’s a good time to buy

- A friend recently bought a home and is convincing you to do the same

- You see there are low mortgage rates currently and fear of future increases

- It’s a buyers market in your city/area

The best reason behind your intention to buy a home should be that you are ready to become a homeowner. This can include having your finances squared away to finally afford home-ownership, needing space for your family to settle down, and being prepared to take on the tasks and responsibilities required as a homeowner.

To help you determine if you are ready, start by considering your long term goals:

- Do you plan to live in your new home for at least 5 years?

- Are you going to be working the same job for the next several years?

- If you quit your job or get fired, do you have alternative income to support your mortgage, property tax, and insurance payments?

- Where do you see yourself living 20 years from now?

- Do you have a family and/or expect kids on the way in the near future?

- How much money do you have saved currently to put towards a home purchase?

- What’s your credit score situation look like? Good, Bad, or Great Credit?

- Are you ready for the responsibilities of being a home owner and maintaining the home?

Asking yourself these questions will help you think into the future and how it will be affected by owning your home.

For example, if you’re going to have 2-3 kids in 5 years from now, you’ll need to account for this by purchasing a home large enough to fit your family. Or if you wish to retire early in life, how will owning a more expensive home vs cheaper home impact your ability to save and invest towards your retirement?

Remember: renting gives you mobility while home ownership plants you in a location along with the larger financial implications that come with it.

Take a moment and jot down future goals and possibilities of how life could go. Now you’re prepared for what to expect and can plan accordingly during your home search process.

What Type of Home Suits Your Needs?

When buying a home for the first time, it can be overwhelming how many options you have. Start by asking yourself these different questions to help you clarify what your needs are:

- Do you want to live in a house, condominium, townhouse, or duplex?

- Do you want to live in the city? Downtown?

- Do you want to live outside the city? How far?

- Do you prefer a short commute to work or will you sacrifice commute time for a dream part of town?

The big question is type of home. Not everyone is ready for the responsibilities of a single family home. You may elect to buy a condominium, which is like apartment community living where you share the building and amenities with other residents at the complex but you own your individual unit. Or perhaps you decide to live in a duplex or small multi family property that has 1 to 4 units where you own the property but share it with a few other people.

First time home buyers with real estate investing knowledge may elect the duplex route where they purchase the duplex, fix up both units and live in one side while collecting rent from a tenant they lease the other side out to. It depends on your financial goals and future plans.

Others may elect to buy a fixer upper home at a discount, live in it while fixing it up, and then flip it for a profit a year or two later. Then they could take these profits and upgrade to a better house or continue with the flipping strategy until they eventually upgrade to a home they are willing to settle in.

You have many options at hand so take a moment again to write down your goals and determine what type of home fits your needs.

What Specific Features Will Your Ideal Home Have?

Do you like window shopping? Because this is a good time to do it.

If you’re unsure what you want in a home, you’ll need to take a look at other homes to help you get an idea of what you like and don’t like. Drive some neighborhoods, attend open houses, set up a few showings.

Let’s go room by room…

Kitchen Features:

- Appliances

- Counter tops

- Cabinets

- Island vs no island

- Layout of the kitchen

- Ceiling height of kitchen

- Lighting

- Flooring

- Back-splash

Dining Room:

- Layout

- Size of Room

- Flooring

- Lighting

Living Room:

- Layout

- Size of Room

- Flooring material

- Fireplace

- Lighting

- Ceiling Height

Bathrooms:

- Size

- Layout

- Lighting

- Vanity & Sink

- Shower

- Toilet

- Color Scheme

- Finishes for the floor and shower: Tile, Stone, etc.

- Bathroom mirror

Bedrooms:

- Layout

- Size

- Closet space

- Flooring material

- Location in the home (upstairs, downstairs, close to the master bedroom, far from the master)

Backyard:

- Pool

- Trees & maintenance that trees require

- Yard size

- Is there a river or lake

- Patio area for tables/chairs

- Fence or no fence

- Suitable for kids & entertainment

Garage:

- Attached or detached to the house

- How many car ports

- Do you need extra space for storage

How Much Mortgage Do You Qualify For?

To qualify for a mortgage you will need the following:

- Good credit

- History of paying bills on time

- A maximum debt to income ratio of 43%

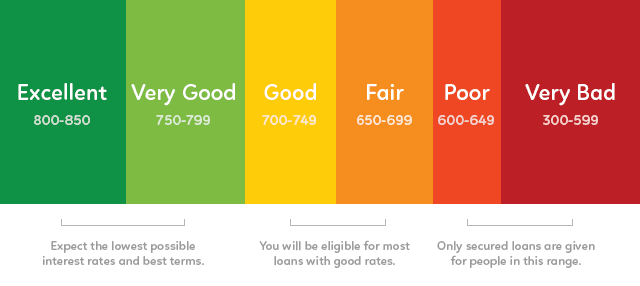

What is considered a good credit score? Take a look at the following image.

History of paying bills will likely include showing proof of utility bills or other bills you’ve recently paid. The bank will also take a look at your credit report to see different debts you’ve paid off or are currently still paying off.

For the debt to income example, consider someone making $4,000/month. 43% of this would be $1,720 which means their total combined debt payment each month can’t exceed this amount. If you have student loans, a car loan, and consumer loans you’re paying off each month, then it will affect how much debt you can take on for a house since your house payment will add to your total debt payment you’re making each month.

How Much Home Can You Actually Afford?

What if you have no debt and an amazing credit score? The bank is likely going to offer you a low interest rate and qualify you for a decent sized loan. Let’s say on paper you qualify for a $1 million dollar home right now. Does this intimidate you? Or would you actually go shopping for a million dollar home?

A bank may give you a loan for more house than you can afford. It’s your responsibility to know how much home you can actually afford and not be enticed by what the bank is telling you to afford.

Consider your financial goals; short term and long term.

The more expensive of home you target, the larger your down payment will be meaning your savings will shrink even more compared to a smaller down payment on a less expensive home. Your monthly mortgage payment will also be larger taking away money you could be saving towards retirement in investment accounts. Plus, don’t forget your annual property taxes owed and property insurance premium which also will increase the more expensive the home you target.

I always recommend the backwards view approach.

Think ahead to retirement and work backwards to determine present day decisions because the decisions you make now will affect you later on in life! You won’t know what decisions to make mathematically without thinking ahead and working backwards.

Consider Joe, our example first time home buyer.

Joe’s future cost of living for him and his wife in retirement is expected to be $40,000 per year. In order to receive $40,000 per year in interest income from investments to cover their cost of living, Joe and his wife will need to save away $1,000,000 as they expect a conservative 4% per year return.

Based on Joe’s current age and time left until retirement, he determines he needs to save away $12,000 per year or $1,000 each month to his 401(k) retirement account.

Joe and his wife’s current combined income is $6,000 per month.

Pause.. Are you following this okay? What we’ve done so far is look ahead to Joe’s future self and determine how much money he needs to save away currently. This takes priority. Once Joe knows how much he needs to save away for his future self and retirement, he can spend all the rest of his money as he wishes.

Let’s resume.

Joe and his wife have an income of $6,000 but after subtracting $1,000 for their future, they truly only have $5,000 per month in income to apply towards current cost of living expenses and needs.

We still haven’t figured out how much house they can afford yet, but we know that there are still other cost of living expenses to subtract from the remaining $5,000 of income before we’ll know how much is left to apply towards the mortgage payment. See what we’re doing here?

We’re prioritizing all other expenses first and whatever remains is how much we have to spend towards housing. Then you can adjust other expenses like eating out or entertainment expenses to increase what you can allocate towards housing.

Let’s say Joe and his wife have the following monthly expenses:

- Car insurance, gas, maintenance = $400/month

- Groceries, eating out = $400/month

- Health insurance = $600/month

- Clothing, Gifts, etc. = $200/month

- Medical Bills = $100/month

- Entertainment = $300/month

We could go on further and list out all their monthly expenses but you see where this is going. As of right now these additional cost of living expenses total $2,000 per month which after subtracting from $5,000 of income leaves just $3,000 of income left to cover a mortgage payment, property taxes, property insurance, and don’t forget monthly utilities that come with a house.

This is how you should approach your personal financial situation. Track your monthly spending for a month and see what each category (food, transportation, medical, entertainment) costs per month to sustain your living habits. You can subtract all of these expenses from your income to get an amount that’s left to dedicate towards your housing costs.

Method #2 for How Much House Can You Afford

Another way to decide is to use a quick rule of thumb. Banks recommend your monthly debt payments toward a house be no more than 36% of your gross income. I recommend taking 36% and multiplying it by your gross income that results after subtracting out your savings for your future self in retirement.

Like in Joe’s case, he’d multiply 36% x $5,000 instead of $6,000 and get a monthly payment of $1,800 instead of $2,160. This ensures he will be able to put away $1,000 per month towards retirement by treating it as if his family’s combined income is only $5,000.

Once you have your projected monthly payment you can afford, there are loan calculators that will tell you how much house this would be.

Assuming you get a 30 year loan and have an interest rate of 4.5% here are some examples:

- $100,000 mortgage and $507 monthly payment

- $150,000 mortgage and $760 monthly payment

- $200,000 mortgage and $1,013 monthly payment

- $250,000 mortgage and $1,267 monthly payment

- $300,000 mortgage and $1,520 monthly payment

Then you should factor in a few hundred dollars per month towards insurance and taxes and an additional few hundred per month for utilities. After adding these onto the principal and interest payment, are you still able to afford that mortgage?

In Joe’s case, he would probably target the $250,000 mortgage with the $1,267 payment because this leaves him $533 to put towards taxes, insurance, and utilities.

Lastly, add on your down payment to the mortgage amount to determine the total cost of the home you’ll be able to afford. For example, if you can afford a $250,000 mortgage with a monthly principal and interest payment of $1,267 then figure another $60,000 towards the down payment meaning a max purchase price of $310,000.

Overall, when you get pre-approved for a loan you’ll know what the bank says you can afford. From there, review your financial goals and determine if you truly can afford this or if you need to adjust this amount downward and go after a less expensive home. A mistake most first time home buyers make is going after too expensive of a home even if the bank says they can afford it. You can always sell your first home and go after a more expensive home later in life when your financials allow it.

Do You Have Serious Savings?

You’ll usually need 20% of the purchase price to put down on a home. You’ll also need additional cash on hand to cover closing costs.

If you’re targeting a $200,000 home, then you’d need $40,000 saved up currently to put down as your 20% down payment. If you only have $45,000 saved, would it be smart to go after this home? It would mean draining your bank account to $5,000 which may not be enough to cover an emergency. Plus don’t forget closing costs.

As a first time home buyer, there are programs that will help you acquire a home for less down. One program for example is the FHA which allows you to put as little as 3.5% down. You’ll be required to take on mortgage insurance though which adds to your monthly payment total as a pre-caution to protect banks in the event you don’t make your mortgage payments.

Who Will Help You Find a Home & Guide You Through the Purchase?

Here are the 3 people you’ll likely rely on:

- Real Estate Buyers Agent

- A close friend or family member

- A spouse, girlfriend, boyfriend

Optional: Real Estate Attorney

You should also connect with a real estate attorney in your city to review the contracts depending on what state you live in. This is an added layer of protection to ensure a smooth home purchase with no legal hiccups.

Ultimate Guide for a First Time Home Buyer – Part 4

The Home Buying Process

18 Steps to Buying Your First Home

Hire a Buyer’s Agent

The first step is to find a real estate agent to represent you as the buyer. Their commission will be paid by the seller so don’t worry about that. Instead focus on the benefits an agent will provide you such as being your guide through all of the steps below in the home buying process.

If you don’t know a real estate agent you trust, ask around to friends and family for referrals. Someone you know has more than likely recently sold or bought a home and could recommend an agent to you.

You can also search online for agents in your city.

A high quality real estate agent will be one who is positive when speaking to you, responds in a timely manner, and points things out to you during the transaction on their own without being asked that you may not have known.

Overall, you’ll be able to instinctively feel that they care about helping you find a home and are working hard for your best interests. If you have a good experience with your agent, be sure to write them a positive review online, film a testimonial video they can use on their website, and/or refer them to friends and family. This is a great way to show your thanks and appreciation for their hard work helping you out.

Get Pre-Qualified / Pre-approved for a Loan

The next step is to get pre-qualified for a loan so that you know what price range of homes you can target. This will prevent you from wasting your real estate agent and the seller’s time going after houses that you won’t qualify for purchasing.

Ask your real estate agent who they recommend using to get pre-qualified for the loan.

Look at Homes for Sale

Once you’re pre-qualified, you’ll want to have already drawn up a list of features you’d like to have in your new home that you can give to your real estate agent.

This will help the agent narrow down the search to find you homes that match your interests and desires.

You can also do some shopping online using a website like Zillow.com or Realtor.com. If you find a home for sale online, email it to your real estate agent so they can set up a showing for you. Don’t email the listing agent because they are working for the seller and won’t have your best interests at heart.

During the showing, your real estate agent will have a listing sheet about the property that tells different features of the property as you walk through. Your agent will also help you look for potential issues with the home that need negotiated if you end up putting the home under contract to purchase with the seller.

Write a Purchase Offer

Once you’ve seen the property and have decided it’s the home you want to purchase, you’ll need to put in an offer.

Your real estate agent will run analysis of the property and share their opinion of value that they think the home is worth to help you determine an offer price to submit to the seller.

If the house is in high demand or it happens to be a seller’s market, expect lots of offers above asking price from competing buyers. If there is a bidding war, be careful not to overpay for the home and remember you can always find another home if this one doesn’t work out.

In a buyer’s market, there are more homes for sale than there are buyers, which usually means buyers get to offer below listing price for the home.

Talk with your real estate agent and determine what you can afford, and what you are willing to pay for a home. He or she will then help you fill out the purchase contract and submit it to the listing agent on your behalf.

At a minimum, the real estate purchase contract will include the following items:

- The mutually agreed-upon sale price

- Earnest money deposit

- Property address and description

- Terms of the sale

- Date of final walk-through

- Date of closing

- Home buyer’s contingencies

Negotiate and Write Counter Offers

One of the important reasons to work with a buyer’s agent is that they are professional negotiators. Your agent understands your real estate market and knows the streets well because they’ve been selling real estate for years. This is advantageous to you, because they understand property values and know how to negotiate the purchase price to get you the best deal they can.

Some things they’ll be negotiating for you include purchase price, closing costs, who pays certain costs, as well as other aspects that are written in the purchase contract.

Make an Earnest Money Deposit

When submitting an offer, you’ll also want to submit earnest money which shows the seller you are serious about your offer and in good faith. It’s usually 1-2% of the purchase price and the check will be held in an escrow account to prevent the seller from cashing the check.

If you pull out of the deal, the seller may get to keep the money. By going through with the deal, the money gets applied on the settlement statement towards the down payment.

Open Escrow / Order Title

At this stage, you will order a title search to be run which we’ve written a detailed guide about here. In simple terms, the title company and/or attorney will research the chain of title to see all the previous owners of the property and make sure the title is clear for being transferred to you as the new owner.

You’ll also want to purchase title insurance policy to protect yourself from damages in the event the title searcher made an error and someone comes after the property claiming they have title to it.

Read this guide on title searches and title insurance

Order Appraisal

When getting financing, the lender will require the home to be appraised so that they can make sure they don’t lend more money than the home is worth. An appraiser will pull recent sales data from very similar properties and compare features of the recently sold properties to determine what this home is worth.

Your lender will likely loan 70-80% of the appraised value but it’s possible that you’ll receive more depending on the lender and any first time home buyer programs you may be using.

For example, the FHA allows you in their program to put as little as 3.5% down in some cases.

Comply with Lender Requirements

Your lender will have lots of documents to sit down and explain to you which include their requirements you must adhere to for their loan.

For example, if you sell the property to someone else, there is likely a clause in the loan stating that the loan becomes due (also known as the “due on sale clause”). This requires you to pay off the loan with the sale proceeds first before you get any of the remaining money left from the sale.

Another example is the rules and terms for missing payments and how they can foreclose on the loan, taking possession of the property if you get behind on payments.

Overall, make sure your real estate agent and lender both review these documents with you and thoroughly explain them so you are aware of the information and understand what these documents are saying.

Approve Seller Disclosures

The seller is required by law to disclose any known issues with the home on a seller disclosure statement. You’ll review this statement with your buyer’s agent and need to approve these disclosures.

Defects that are pointed out about the home on the seller disclosure statement or during a showing can be negotiated with the seller about fixing them or crediting money on the settlement statement at closing.

The importance of a seller disclosure statement is to make the buyer aware of any issues so that once the buyer purchases the home there are hopefully no surprises that result in lawsuits.

Order Homeowner’s Insurance Policy

As a first time home buyer, you’ll likely need to have the different insurance policies explained to you by an insurance agent. You can get different types of coverage and depending on where you live, there will be different requirements. For example, if you live in an area prone to flooding, you may need to get flood damage insurance.

Consider getting quotes from a few different insurance agents and review the policies with your attorney or someone with home owner’s insurance experience that can help you decide on a policy.

Conduct Home Inspection

Even though the seller disclosed known defects on the seller disclosure statement, you still want to have an inspection done on the home by a professional. This can reveal any structural/foundational defects as well as other issues with the home that may not have been stated by the seller.

The worst thing that can happen is taking over a home and finding an expensive issue with the home that you’ll have to pay for.

Issue Request for Repair

Talk with your real estate agent about issues you want to request the seller to repair and your agent can communicate these to the seller and listing agent. There will be some back and forth negotiation about what the seller will or will not fix as well as what the seller may credit you in monetary value towards the purchase on the settlement statement.

If certain issues with the home are major, you may be able to back out of the purchase contract. Most contracts have an inspection clause in them so make sure to talk to your real estate agent about this clause and the way it works. It could be a release that allows both parties out of the contract without any monetary losses (earnest deposit money or damages for breaching a contract).

Remove Contingencies

The contract will build in a certain amount of time (probably several weeks) between the contract signing and final “closing” of the deal. (In some states, this period is called “escrow.”)

During this time period, you and the seller will be working hard to meet or remove the various contingencies, for example, by securing a loan and scheduling inspections. You’ll need to update each other on the progress being made as well.

Typical contingencies may include:

- Inspection by the buyer

- Ability to obtain financing

- Home appraisal

- Sale of current home

- Clear title

Do a Final Walk-Through

Either on the day of closing or the day prior, you’ll usually schedule a final walk through of the property to ensure its condition hasn’t been altered. The seller will also sign a statement that nothing has changed to their knowledge.

Any last minute issues found may delay closing as a result but it protects you from taking over a property that has issues.

Sign Loan / Escrow Documents

At closing, you’ll usually meet face to face with the seller. Each of you should have your respective real estate agent with you at this meeting (seller with the listing agent and buyer with his/her buyer’s agent).

Other parties that may sit in the closing meeting include a representative from the lending institution as well as attorneys for either party.

You’ll be responsible for signing off loan documents as well as any other documents presented to you by the escrow officer, who has the legal authority to conduct the closing between you and the seller.

Deposit Funds

A settlement statement will be created for the buyer and seller highlighting all the different debits and credits of the transaction.

The buyer will receive a total debit amount (expense) that he/she owes.

You’ll be responsible for writing a check or wiring in money to the escrow account as well as any money needed brought to closing to cover closing costs.

To learn about the expenses of buying a home read this guide here: Ultimate Guide to Home Buyer Costs.

Close Escrow

The closing officer will account all fund and disperse them to all the parties of the transaction. You’ll be handed keys from the seller to take possession of the property and start your journey as a new home owner! CONGRATS!

Next we will cover the final section of the first time home buyers guide which is the things to do after you take over as the new owner of a home.

Ultimate Guide for a First Time Home Buyer – Part 5

What to Do as a New Home-Owner

Upon taking over your new home, there will likely be lots of work to be done.

For starters, you’ll need to arrange moving plans to bring all of your items from your old home to your new house. Talk with friends and family about helping you move and consider the costs of hiring a moving truck if you have big items that need transported.

If you bought a fixer upper home that needs lots of work you may consider fixing these items as quickly as possible before moving all of your stuff in. It will be less crowded initially, allowing you to complete the dirty work before you bring your materials in and start filling out the space of the home.

Minor Repairs & Fixes to Make

- Replace light bulbs ($40)

- Dust every room and clear vents from dust/obstructions

- Install new ceiling fans ($80)

- Check the temperature of your water heater

- Install smart electronics to save money such as a Nest Thermostat

- Change locks and keys and make sure to have spares made

- Look into energy based improvements that will save money and get you tax incentives

You’ll also want to build your home maintenance checklist of tasks that you’ll need to do weekly, monthly, quarterly, and/or annually. Run through it for the first time to get a feel for all the tasks.

You may also consider painting your new home so that is has a fresh feeling and the walls appear stain free if marks and gouges existed before. Lighter paint colors will help brighten a room when sun shines into the room (ex: white or light tan, light grey, etc.).

You’ll also want to inspect all plumbing again and ensure there are no water leaks from these appliances. Check the attic insulation as well to see if you need to add more insulation to save money on your heating bill.

Spend the first few months with low to moderate use of utilities and heat/cooling system to get a baseline for what your utility bills will run. Then you’ll be able to determine high usage months from average months.

Overall, it’s important to keep up with maintenance of your home to save money over the long run of things breaking down that could have been prevented. Over time if you make improvements to your home such as remodeling the kitchen or bathrooms, you may actually increase the value of your home to some extent. Consider the cost vs benefit when making upgrades to ensure you don’t overspend and not recoup this money later if you go to sell the home.

Enjoy being a new homeowner. It’s a great accomplishment to admire and appreciate in life. Thanks for reading this ultimate guide to becoming a first time home buyer!